In today’s interconnected world, sending money across borders has become a necessity for many. Whether you’re supporting family overseas, making business transactions, or paying for services in another country, finding a reliable and efficient way to transfer funds is crucial. Enter WorldRemit: the revolutionary service that makes international money transfers as easy as clicking a button. With its user-friendly platform and robust security measures, WorldRemit stands out among traditional banking methods and other remittance services. Let’s explore how this innovative solution can simplify your global money transfer needs while saving you time and money along the way.

How does WorldRemit work?

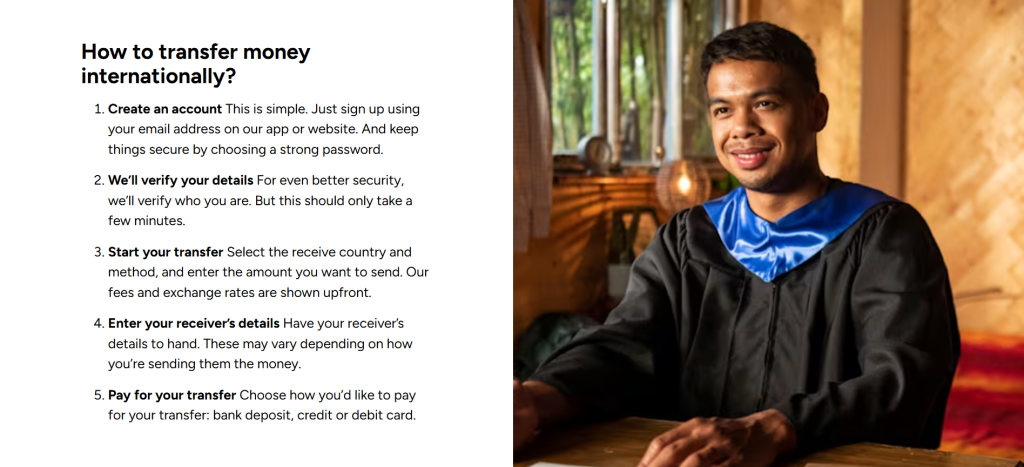

WorldRemit simplifies the process of sending money across borders. Users begin by creating an account on their website or app, a straightforward step that requires basic information.

Once registered, you can choose from various transfer options. Options include bank deposits, mobile airtime top-ups, and cash pickups. This flexibility caters to different needs and preferences.

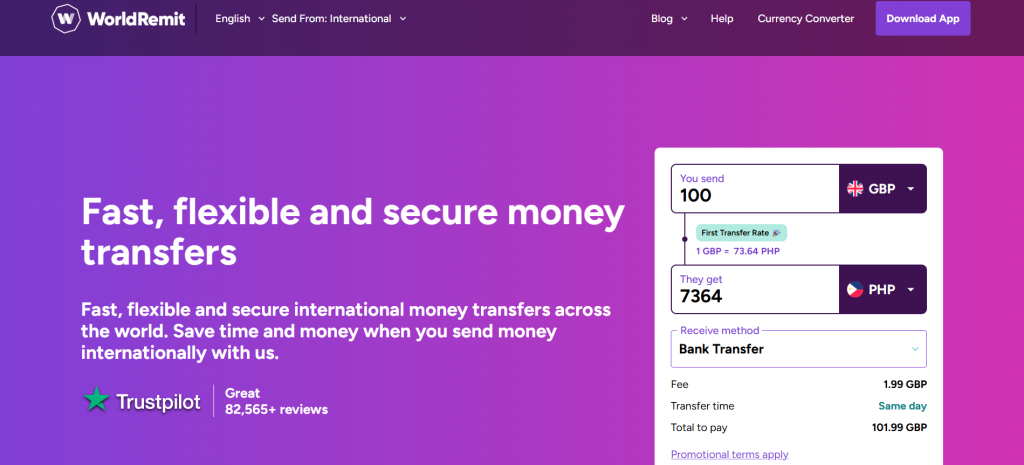

Next, enter the recipient’s details and the amount you wish to send. WorldRemit offers competitive exchange rates that ensure your loved ones receive more value for their money.

After confirming the transaction, funds are typically delivered within minutes. Notifications keep both sender and recipient informed about the status of the transfer.

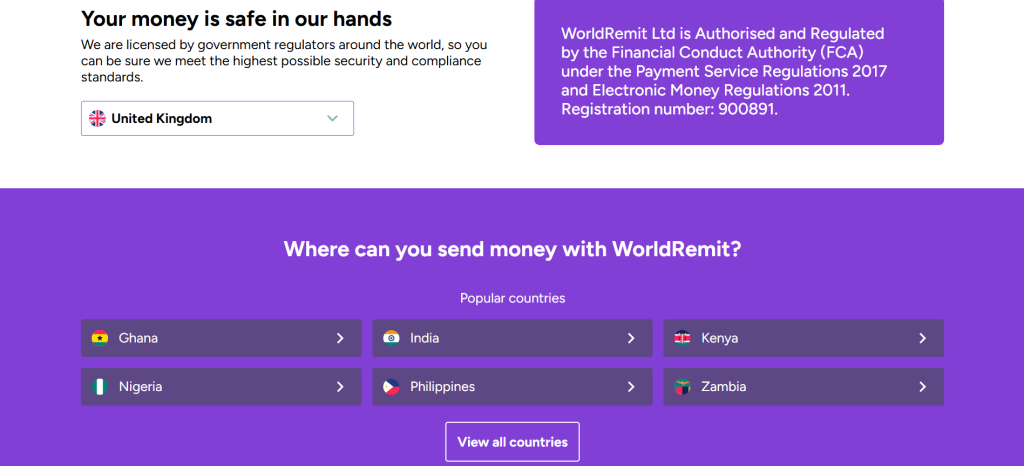

With robust security measures in place, users can trust that their transactions are safe while enjoying a seamless experience throughout each step of sending money internationally.

The Benefits of Using WorldRemit for Global Money Transfers

WorldRemit stands out as a top choice for international money transfers. One of its key advantages is the speed at which transactions are completed. Sending funds can often be instantaneous, allowing recipients to access their money without unnecessary delays.

Another highlight is the competitive exchange rates offered by WorldRemit. This ensures that users get more value for their money when sending funds across borders.

The platform provides various transfer options, catering to different needs. Whether it’s bank deposits, mobile top-ups, or cash pickups, there’s something for everyone.

Furthermore, WorldRemit’s user-friendly interface makes navigation easy for all ages and tech-savviness levels. The straightforward process minimizes confusion and enhances the overall experience while managing your finances globally.

A. Fast and Secure Transactions

When it comes to sending money internationally, speed is crucial. WorldRemit excels in this area, ensuring that your funds reach the recipient quickly. Many transactions happen within minutes. This means you can help loved ones during emergencies without delay.

Security is equally important. WorldRemit employs cutting-edge encryption technology to protect your personal and financial information. They follow strict guidelines and regulations, making sure every transaction remains safe from prying eyes.

The combination of fast delivery and robust security gives users peace of mind. You can focus on what matters most—supporting friends or family around the globe—while knowing that your money transfer is handled with care and efficiency. With WorldRemit, there’s no need to worry about potential risks; they prioritize user safety at every step of the process.

B. Competitive Exchange Rates

WorldRemit stands out for its competitive exchange rates, making it a preferred choice for many users. When sending money across borders, every cent counts. With WorldRemit, you can be confident that your funds will go further.

The platform constantly updates its rates to reflect market changes. This means you get the most value when transferring money internationally. Many services charge hidden fees or offer less favorable rates; however, WorldRemit is transparent about what you’ll receive.

Additionally, they provide real-time calculations before finalizing your transfer. You can see exactly how much the recipient will get in their local currency. This clarity helps avoid surprises and ensures better budgeting for both sender and receiver.

With WorldRemit’s commitment to providing competitive exchange rates, managing international finances becomes simpler and more cost-effective for everyone involved.

C. Wide Range of Transfer Options

WorldRemit stands out for its diverse transfer options. Users can choose from various methods to send money, catering to individual needs and preferences.

You can opt for bank transfers, mobile airtime top-ups, or cash pickups at local agents. This flexibility ensures that recipients get their funds in a way that suits them best.

For those who prefer instant solutions, WorldRemit also offers digital wallet transfers. These transactions are quick and efficient, making it easier than ever to support loved ones abroad.

Additionally, with the option of sending payments in multiple currencies, you have more control over how your money is transferred. Tailoring your choices makes every transaction smoother and more personalized.

Whether it’s paying bills or supporting family members overseas, the wide range of transfer options puts convenience right at your fingertips.

D. Convenient and User-Friendly Platform

Navigating the WorldRemit platform is a breeze. Its design prioritizes user experience, making it easy for anyone to send money online.

With just a few clicks, you can initiate a transfer from your smartphone or computer. The interface is clear and intuitive, which reduces confusion during transactions.

WorldRemit’s app offers an additional layer of convenience. You can manage everything on the go—no need to visit brick-and-mortar locations or wait in long lines.

The platform supports multiple languages and currencies too. This inclusivity ensures that users worldwide feel at home while using their services.

Whether you’re sending funds to family abroad or paying for international services, WorldRemit makes it seamless and straightforward. It’s all about putting control back in your hands when it comes to international money transfers.

Customer Reviews and Testimonials

WorldRemit has garnered a loyal customer base, with many users sharing their positive experiences. People appreciate the platform’s efficiency, often highlighting how quickly their money reaches recipients.

Many testimonials mention the ease of use. Whether sending funds to family or friends abroad, customers find the process straightforward and intuitive. This user-friendliness makes it accessible for everyone.

Security is another common theme in reviews. Customers feel reassured knowing their transactions are protected by advanced encryption technology.

Moreover, users frequently point out competitive exchange rates that save them money on transfers compared to traditional banks.

The variety of transfer options also receives praise. From bank deposits to mobile airtime top-ups, clients love having flexibility in how they send money globally.

These insights reflect a strong satisfaction among WorldRemit users and underline its position as a trusted service for international money transfers.

Comparison with Other Money Transfer Services

When evaluating money transfer services, WorldRemit stands out against traditional banks and other providers like Western Union. Unlike these older systems, WorldRemit leverages technology for faster transactions.

Many conventional services often have hidden fees that can catch users off guard. In contrast, WorldRemit’s transparent pricing structure allows customers to see the total cost upfront.

Another key difference is convenience. While some competitors require a physical visit to an agent location, WorldRemit offers the ability to send money online from anywhere with internet access. This flexibility appeals to busy individuals who prefer managing finances on their own terms.

Additionally, while some companies limit payment methods, WorldRemit supports various options including bank transfers and credit card payments. This adaptability makes it easier for users to find a method that suits their needs best.

Tips for Making the Most Out of WorldRemit

To maximize your experience with WorldRemit, start by familiarizing yourself with the app. A little exploration goes a long way. Check out all its features and options.

Consider scheduling transfers during off-peak hours. This can help you avoid delays and ensure prompt delivery of funds.

Always review exchange rates before making a transfer. Taking just a few minutes to compare rates could save you money in the long run.

Utilize promotions or referral programs if available. These offers can provide discounts on fees or bonus credits for future transfers.

Keep track of your transaction history through the app. Staying organized will help you manage finances better and spot any discrepancies quickly.

Conclusion

When it comes to sending money internationally, choosing the right platform can make all the difference. WorldRemit stands out as a reliable option for those looking to transfer funds across borders. With its fast and secure transactions, competitive exchange rates, and an array of convenient options, it’s designed with the user in mind.

The user-friendly platform simplifies the process of global payments. Customer reviews often highlight not only the efficiency but also the ease with which transfers can be made. Compared to other services in this space, WorldRemit consistently earns high marks for its swift service and transparent fees.

For anyone considering using WorldRemit: International Money Transfer – Send Money Online offers a seamless experience that caters to diverse needs. Whether you’re supporting family abroad or managing business expenses overseas, this service provides peace of mind while ensuring your money reaches its destination quickly and safely.

Making informed choices is essential when transferring money globally. By understanding how WorldRemit works and utilizing its features effectively, users can enhance their international financial interactions significantly. Embrace modern technology in banking—it’s tailored just for you!